Out of every dollar that funds Wisconsin' s pension and health insurance plans for state workers, 100 cents comes from the state workers.So when you read a story like this one, bemoaning public employee pensions, understand that what you are really reading is a story bemoaning public employee compensation:

How can that be? Because the "contributions" consist of money that employees chose to take as deferred wages – as pensions when they retire – rather than take immediately in cash. The same is true with the health care plan. If this were not so a serious crime would be taking place, the gift of public funds rather than payment for services. [emphasis mine]

It makes no sense to say that pensions are too generous as if that's separate from compensation. When you complain that a cop or a firefighter or a teacher is getting too generous of a pension, what you're really complaining about is that public employee's pay.

Of course, some of those drawing the pensions see the issue differently. George Kielb, a 55-year-old retired Yonkers fire commissioner, said he worked 33 years in a grueling job to earn his pension. Kielb is entitled to $139,745 a year. He recalled that he started as a firefighter in 1979, making about $12,000 -- far less than his peers were making in factory jobs. He said that the politicians who negotiate contracts too often point the finger at workers when budgets are scrutinized."The people who are doing the jobs don't set the policies," Kielb said. "When everything doesn't turn out like they thought, they blame the worker for what they gave you."Hartsdale Fire Chief Ed Rush defended the pensions of three deputy chiefs who retired from his department. They, too, were among the Hudson Valley's top 10 new pension earners: Richard G. Leo with a pension of $186,510, Michael F. Vicari with $141,602 and Peter H. Hirsch with $139,077."It's an extremely demanding job, and it's something that the guys are earning," Rush said. He said he resents the use of the term "pension padding" in relation to police and fire pensions.In New York, pensions for most police and firefighters are based on either the highest one-year salary or an average of the three highest years of pay, including overtime. Critics of the system have charged that police and firefighters cooperate to maximize overtime just before an individual's retirement, in effect "padding" pensions."Some of the public sentiment makes it seem as if police and firefighters are getting handouts ... it's not. The guys are earning it," Rush said. [emphasis mine]

The plain truth is that both public employees and employers came to an agreement back when the employee was hired: the employee would accept less money upfront and defer his compensation, while the employer agreed to pay the employee later. This should be a good deal for the taxpayer: it allows the employer to use investments to subsidize employee pay.

The trick, of course, is to make sure that the employer sets aside enough money to invest and thus meet that employer's obligation in the future. It isn't the employee's fault if the employers don't meet their obligations; if politicians refuse to fully fund pensions so they can give tax gifts to the wealthy, it isn't the fault of public employees.

This framing of the situation, however, is unacceptable to conservatives who are so desperate to keep taxes on the rich low that they would allow governments to break their promises to employees. They have an incentive to demonize public workers, which explains why they want to do things like this:

Why? What's the point? What purpose is served by revealing the names of public employees and the amounts of their pensions?A state appeals court in Albany ruled Thursday to keep private the details of teachers' pensions, the latest in a string of rulings against disclosure of public pensions.Most public pension systems in New York have refused in recent years to release details about pension recipients and how much they are receiving in retirement. The only one to keep the information public is the state retirement system, the largest pension program with more than 1 million active members and retirees.The fiscally conservative Empire Center for New York State Policy sued the state Teachers' Retirement System last year after the agency decided in 2011 to no longer release the names of teachers receiving taxpayer-funded pensions. The system said it made the decision after a state appeals court ruled in October 2011 that a New York City police pension fundwas off limits to the public.

[...]“The lower court and intermediate appellate rulings in these cases are clearly wrong and are an affront to taxpayers’ rights to have access to what always has been, and should continue to be, treated as public information,” said Tim Hoefer, the group's executive director, in a statement.Bob Freeman, executive director of the Committee to Open Government, said the courts are erring in their rulings. He said the pension information has long been public and should remain so."It has always been the view of the Committee on Open Government that the identity of a public employee, present or former, should always be public," Freeman said. [emphasis mine]

It's simple: revealing pensioner names and pension amounts intimidates pubic employees. It keeps them from demanding that governments meet their obligations by painting pensioners as greedy. It creates a framework where pensions are not seen as compensation earned, but as gifts given. It creates a false image of public employees as overpaid, when nothing could be further from the truth.

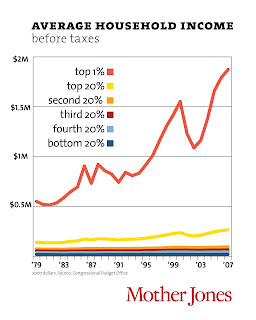

Demonizing public employees is a distraction to keep people from realizing our shrinking middle class is caused not by public employee "greed," but by an aristocracy that has paid politicians to rewrite the rules so that plutocrats take more of the money and pay less in taxes.

The only question left to ask is how long the American people will continue to fall for this con job.

No comments:

Post a Comment